Internet Banking Cybersecurity Program

On June 28, 2011, the FFIEC issued a supplement to the Authentication in an Internet Banking Environment

guidance released in October 2005. The purpose of the supplement is to reinforce the guidance's risk-management

framework and update the FDIC, OCC, NCUA, and FRB's (collectively, the Agencies') expectations

regarding customer authentication, layered security, or other controls in the increasingly hostile online banking environment.

CoNetrix has developed an online software to help financial institutions (i.e., banks, credit unions, savings

associations, etc.) go through the risk assessment process and provide customer awareness and education. The

Tandem Internet Banking Security Program is a stand-alone software

product integrated with the Tandem Security & Compliance

online software.

Risk Assessment and Controls Evaluation

Provide a Risk Assessment and Controls Evaluation to your commercial customers to help them perform a simple assessment of their e-banking security practices.

A printable Microsoft Word document is available, as well as an interactive web application. Source code for the interactive web application is provided so you can embed the assessment into your organization's existing website.

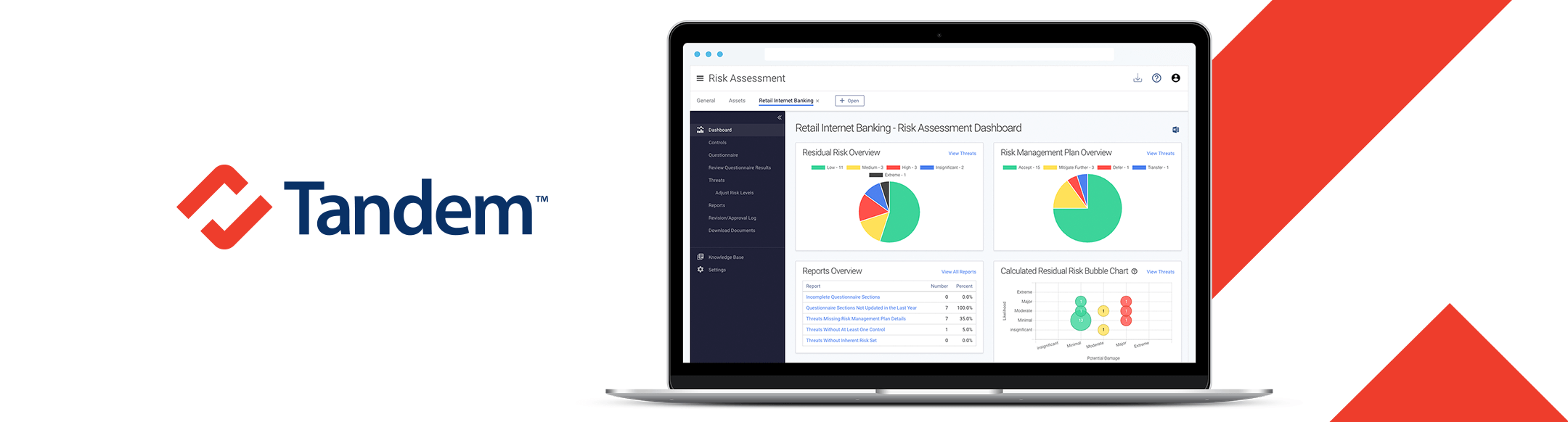

Dashboards

Review visual representations of your internet banking risk assessments on each assessment's dashboard.

Evaluate useful insights into your risk assessment data, as well as a series of reports, designed to ensure your assessment does not contain any missing or incomplete data.

Downloads

Generate consistent and professional documents effortlessly to share with your senior management, board of directors, auditors, and examiners.

Download a summary document to provide a compilation of the data across all of your internet banking risk assessments, or export each individual risk assessment, as needed. These customizable documents are available in Microsoft Word and Adobe PDF formats.

The program is divided into two components:

-

The Internet Banking Risk Assessment features an easy process with a questionnaire to identify

risk levels and help you assign layered controls to mitigate related Internet banking and cybersecurity risk. Your

risk assessment is customizable based on your financial institution's unique situation.

-

The Customer Education/Awareness Program will provide your financial institution with the tools

to deliver education and security awareness to your customers.

In addition, the Tandem Internet Banking Security software will provide you with account takeover (ATO/CATO)

template documents to assist in your annual reporting to the board and documenting of incident response procedures.

Features

The CoNetrix Tandem Internet Banking Security Program software is feature-rich, including:

- An online framework created and updated by security and compliance experts

- Downloadable documents in Microsoft Word and/or Adobe PDF formats

- New features and updates are automatically included with your annual subscription

- Free training workshops to help familiarize you with the software

- Integration with other CoNetrix online software

- Anywhere/anytime Internet access through a secure, online portal

- Multi-factor authentication (optional)

- Single Sign On (SSO) integration using SAML 2.0

- Multi-user access

- No software installation or equipment costs

-

The ability to manage several companies' Risk Assessments and Training with one login (requires a subscription for

each company)